The Microsoft Cloud Solution Provider (CSP) ecosystem has undergone a significant transformation under the Microsoft CSP 2026 program changes. If you are a CSP partner, the changes rolling out for fiscal year 2026 will be reshaping who can participate in the program and how profitability will be determined moving forward. Starting October 1, 2025, Microsoft has implemented substantial new revenue minimums, operational requirements, and capability thresholds. These will directly impact authorization status, incentive eligibility, and your ability to transact CSP licenses.

The new requirements, which include higher revenue minimums, mandatory Solutions Partner designations, and stricter security and compliance standards, are intended to eliminate partners who treat the CSP program as a simple resale model and reward those who genuinely add value through their services and solutions. CSPs that plan and adapt early will gain a competitive advantage, those who delay risk losing their place in the program.

This blog will demystify the 2026 CSP program changes, explain the strategic reasoning behind Microsoft’s moves, and lay out a clear roadmap for CSPs to adapt, grow, and stay profitable under the new framework.

What Changed in the Microsoft CSP 2026 Program – New Eligibility and Revenue Thresholds

The changes rolling out in Fiscal Year 2026 (effective October 1, 2025) are the most significant in the CSP program’s history. Here is what is changing under the CSP revenue thresholds 2026:

- Direct-bill partners must now demonstrate a minimum of US$1,000,000 in trailing-twelve-month (TTM) CSP billed revenue at the Partner Global Account (PGA) level. This is a significant jump from the earlier threshold of roughly $300K.

- Indirect Resellers will need to comply with:

- Authorization Minimum: $1,000 USD TTM billed revenue per Partner Location Account (PLA) is required to simply remain authorized to transact in the CSP program.

- Incentive Eligibility Minimum: $25,000 USD TTM billed revenue per solution area is required to be eligible for incentives.

- Indirect Providers (Distributors) must now demonstrate a massive US$30M TTM in CSP revenue per authorized region, signaling a push for consolidated, globally-capable distributors.

Timing: These rules are phased, but the core financial and designation requirements take full effect for annual reassessments starting October 1, 2025.

Why Microsoft is Making These Changes

Over the past decade, the CSP model has grown exponentially, with tens of thousands of partners worldwide reselling Microsoft subscriptions. While this rapid growth has increased market reach, it has also created operational challenges: inconsistent customer experiences, compliance gaps, and difficulty distinguishing mature partners from mere resellers.

Microsoft is shifting focus from partner volume to partner quality. By raising entry barriers, Microsoft ensures that only partners with measurable scale, specialization, and customer impact remain active in the CSP program. Higher revenue minimums also consolidate the market, allowing Microsoft to work closely with a smaller number of partners who demonstrate strong customer engagement and operational strength.

The cloud market itself is expanding at a fast pace, growing from USD 752 billion in 2024 to an expected USD 2,390.18 billion by 2030. With such rapid growth, Microsoft needs partners who can support complex customer transformations rather than only transact licenses. The FY26 model reflects Microsoft’s strategic shift toward AI-driven and cloud-first solutions, including Copilot and advanced cloud workloads. To deliver these effectively, Microsoft needs partners who possess strong technical expertise, maintain consistent and reliable support standards, and can efficiently manage complex, multi-tenant customer environments.

The cloud market has matured, and customers now expect more than just license sales. They look for expert guidance, proactive management, and seamlessly integrated solutions. By increasing partner requirements, Microsoft is making it clear that simply reselling licenses will not work. The future belongs to partners who offer complete solutions, provide active support, and create lasting value for customers

Who is Affected by the New Revenue Minimums

Every CSP partner is affected by the Microsoft CSP 2026 program changes – the impact varies depending on your role and current revenue size.

Direct-Bill Partners

The partners who had built a profitable business generating $300K-$900K revenue would need to either scale aggressively or transition to the indirect model before their next annual review. If you are a large direct bill partner already above the $1M threshold, these changes can be an opportunity for you to increase your market share, as competition will be reduced.

Indirect Resellers

The $1,000 authorization minimum will eliminate inactive and low-volume resellers who maintain CSP tenants but rarely transact.

Distributors

The $30 million regional threshold shows that Microsoft wants to partner with fewer, larger, and more advanced indirect providers that operate across multiple regions. Smaller distributors working in a single region may need to merge with or partner with bigger providers to stay competitive.

Deep Dive: The Million-Dollar Bar for Direct Bill Partners

The most significant change is the jump from $300K to $1M in annual CSP billed revenue for direct-bill authorization.

The New Revenue Threshold

Effective with FY26 reviews (October 1, 2025 onward), Microsoft requires all direct-bill partners to maintain at least $1,000,000 in TTM CSP revenue at the PGA level. Partners currently sitting in the $300K – $999K bracket are the most impacted as they are too big to fit smoothly into an Indirect Reseller model without major adjustments, yet too small to reach the new $1 million requirement through normal growth.

Mandatory Specialization: Solutions Partner Designation

The requirement to hold at least one active Solutions Partner designation (in areas like Modern Work, Security, Infrastructure, or Business Applications) is now a core condition of authorization. These designations prove the partner’s technical readiness and customer success track record.

This is where pure aggregators will be separated from true solution providers.

Your top priority should be earning the capability score for your first Solutions Partner designation. Start by using your current trailing twelve-month (TTM) revenue as a base, then assess your team’s existing skills and align them with the certification requirements for the designation you are targeting.

The Operational Assessment and Support Mandate

Direct partners will also undergo an automated operational assessment covering billing accuracy, provisioning reliability, security posture, and support infrastructure. This is effectively a performance audit to ensure partners have systems capable of handling large-scale CSP transactions.

Additionally, every direct-bill partner must hold an active Advanced Support for Partners (ASfP) or Premier Support for Partners (PSfP) contract.

Strategic Decisions for Direct Partners

Direct-bill partners below $1 million have two primary paths forward:

Path A: Aggressive Growth

Reaching the $1 million threshold before the review date requires a combination of strategies:

- Expand customer acquisition: Double down on mid-market and enterprise clients that require multi-license solutions (e.g., M365 E5, Copilot, Security).

- Focus on high-value bundles: Combine Microsoft 365, Defender, Intune, and Azure Backup into recurring managed service offerings.

- Pursue vertical specialization: Target industries like education, healthcare, or manufacturing where compliance-driven workloads can boost seat volume quickly.

- Consider M&A: Consolidation among small CSPs can help reach scale faster and maintain direct-bill status.

Path B: Planned Transition to Indirect Reseller

If reaching $1 million isn’t realistic or desirable, transitioning to an indirect reseller model may be the optimal path. This requires:

- Select the right distributor: Evaluate indirect providers based on their service capabilities, margin programs, back-office tools, and cultural fit. The best distributors offer robust billing automation, compliance support, and co-sell facilitation.

- Maintain customer relationships: Communicate transparently with customers about the transition. Emphasize that you remain their trusted advisor and service provider.

- Understand the trade-offs: You will give up some margin points, but you will also eliminate the cost of maintaining direct-bill infrastructure, support plans, and compliance overhead.

Deep Dive: Implications for Indirect Partners (Resellers & Distributors)

Although direct bill partners will be the most affected by the new revenue minimums, the indirect partners will also see stricter requirements around performance, capability, and compliance under the FY26 model.

The Indirect Reseller Mandate

At the Partner Location Account (PLA) level, resellers must maintain:

- $1,000 USD TTM billed revenue to remain authorized to transact as a CSP.

- $25,000 USD TTM billed revenue to qualify for incentive payments in a specific solution area.

This ensures that only active, revenue-generating resellers stay in the CSP program. Dormant or inactive PLAs will gradually be deauthorized.

Incentive Eligibility and the 25-Point Rule

Indirect resellers must now either achieve a Solutions Partner designation or accumulate 25 Partner Capability Score (PCS) points in the relevant solution area to unlock incentives.

For indirect resellers not yet at the designation level, this is a practical shortcut. Earning certifications such as MS-900 (Microsoft 365 Fundamentals) or AZ-900 (Azure Fundamentals) can quickly build PCS points and restore incentive eligibility.

Distributor Requirements

Microsoft’s move to set a $30M TTM minimum per authorized region significantly changes the distributor landscape. This threshold is intentionally high and designed to ensure that only providers with proven scale, financial stability, and advanced operational infrastructure remain in the program. Smaller distributors and niche indirect providers will find it increasingly challenging to meet this bar, which means consolidation will happen. Smaller distributors will either need to:

- Consolidate through acquisition or merger with larger providers

- Partner with a larger distributor and become a sub-distributor

- Exit the CSP business and transition customers to alternative models

Strategic Roadmap: Navigating the 2026 CSP Transition

With reassessments beginning October 1, 2025, immediate action is important. You need to execute this road map in two phases:

Short-Term Plan (0 – 6 Months): Stabilize and Reassess

The immediate goal is to understand your position, secure compliance, and protect current revenue streams. To achieve this, you need to

Audit Your TTM Revenue and Eligibility

- Validate your trailing twelve-month CSP revenue across each Partner Global Account (PGA) or Partner Location Account (PLA).

- Check how close you are to the $1K, $25K, and $1M thresholds and document any gaps.

- Identify any tenants that are below the $1,000 mark and create a plan to consolidate or grow them.

Review Partner Center Compliance Metrics

- Update your security score and ensure MFA is active across all user accounts.

- Close any pending Partner Center alerts related to POR or validation.

- Reconfirm your Solutions Partner designation progress and PCS status.

Engage with Your Distributor or Partner Development Manager

- Have a clear conversation about how the new thresholds affect your partner status and rebate eligibility.

- Explore moving to an indirect model if meeting the direct-bill threshold seems unrealistic.

Revisit Pricing and Product Bundles

- Introduce short-term offers or bundles that drive recurring seat growth (for example, Microsoft 365 + Defender or Azure + Backup).

- Promote multi-year subscriptions to lock in TTM stability and predictable cash flow.

Secure Cash Flow and Margins

- Automate billing reconciliation and reporting.

- Reforecast revenue quarterly to measure progress against the new thresholds.

- Identify cost reductions through license optimization and centralized provisioning.

Long-Term Plan (6–24 Months): Transform and Grow

Once compliance and revenue continuity are ensured, the next step is to future-proof your CSP business model. The long-term roadmap focuses on growth, specialization, and automation.

Build Value-Added Services

Transition from being a license reseller to a solution provider. Bundle managed security services, cloud optimization consulting, compliance automation, and AI adoption programs into recurring contracts. Premium services command higher margins and lead to customer retention that pure licensing cannot achieve. Use your CSP expertise to create end-to-end transformation bundles, helping customers modernize, secure, and automate their business.

Strengthen Operational Infrastructure

As revenue thresholds rise, manual billing and reconciliation, and disconnected reporting will become growth bottlenecks. Automate everything that can slow your business down, from invoicing and reconciliation to incentive tracking and customer provisioning. Implement unified dashboards that provide real-time visibility into TTM performance against thresholds. This not only improves accuracy but also frees up your team to focus on customer growth.

Invest in tools that streamline CSP billing, provisioning, and simplify multi-tenant management. The more predictable and transparent your internal systems become, the easier it is to maintain profitability at scale.

Achieve and Leverage Solutions Partner Designations

Solutions Partner designations represent trust, maturity, and consistent customer success. Don’t just meet the minimum one-designation requirement. Build multiple designations that align with your service portfolio.

To start with, focus on earning the designation that best reflects your current strengths, whether it’s Modern Work, Security, Infrastructure, or Data & AI. Once you achieve a designation, use it to differentiate your brand in customer conversations, position yourself for enterprise deals, and strengthen your relationship with Microsoft account teams. Read our blog to learn more about leveraging solutions partner designations to grow your Microsoft CSP business.

Invest in Customer Success and Renewals

As revenue thresholds rise and incentive rules become stricter, every renewal, upsell, and usage expansion becomes essential to sustaining TTM performance. As a result, you deploy customer success programs that do more than just solve issues. The customer success programs should actively drive value, adoption, and long-term loyalty.

Start by tracking customer health, usage patterns, and upcoming renewal milestones. The more visibility you have into how customers are using Microsoft 365, Azure, and security workloads, the easier it is to identify opportunities for optimization, right-sizing, or cross-sell.

Help clients get more from their existing licenses, show them where security gaps can be closed, and introduce them to AI capabilities and automation tools that sharpen their competitive edge. When customers see you as a partner who elevates their business outcomes, it improves renewal rates and upsell opportunities.

Plan for Scalability and Strategic Partnerships

As Microsoft raises the revenue threshold to remain in the CSP program, scalability becomes necessary for survival and not just a growth tool. To remain competitive, you need to plan to strengthen your operational footprint, expand your reach, and build partnerships.

Look for opportunities that can help you grow strategically. This can include partnering with complementary MSPs and niche security or compliance specialists, or exploring mergers and acquisitions that help you expand your customer base and technical depth.

Scalability also means expanding into new markets or verticals where your capabilities naturally fit. Whether it’s SMB digital transformation, regulated industries, or AI adoption programs, aligning with Microsoft’s growth priorities ensures that your business stays relevant.

Continuously Monitor Policy and Program Updates

The Microsoft CSP program is constantly evolving with Microsoft introducing policy updates, incentive adjustments, mandatory requirements, etc. With all these changes, staying compliant is no longer something you review once a year, it needs to be an ongoing activity.

Carry out monthly checks of Partner Center announcements, quarterly reviews of your designation progress, and periodic syncs with your distributor or PDM to understand what’s changing. This not only keeps your team informed but also helps you anticipate requirements that may impact your TTM performance or incentive eligibility.

Beyond compliance, this continuous monitoring gives you a competitive advantage. When you’re among the first to understand the changes and policy updates, you can pivot faster, realign your strategy sooner, and position your business ahead of slower-moving competitors.

Microsoft’s FY26 program changes are not about reducing partners but having partners who can deliver consistent value, maintain strong operational discipline, and guide customers through increasingly complex cloud and AI-driven transformations.

Under the CSP revenue thresholds 2026, the $1M threshold for direct-bill partners is designed to identify partners with structured operations, predictable revenue, recurring services, and the internal capabilities Microsoft wants. Those partners who are able to meet this threshold will get better incentives and opportunities to co-sell and co-deliver high-value cloud solutions.

Indirect resellers who will proactively adapt, strengthen designations, automate billing and reporting, will have access to incentives that were previously not available to them. The new $30M TTM revenue requirement per authorized region for distributors will ensure that distributors have the financial strength, operational infrastructure, and support capabilities to handle large, multi-tenant CSP environments reliably.

For resellers, this change can actually improve the overall experience. Fewer distributors who are far more capable can offer better onboarding, stronger partner enablement, and quicker issue resolution.

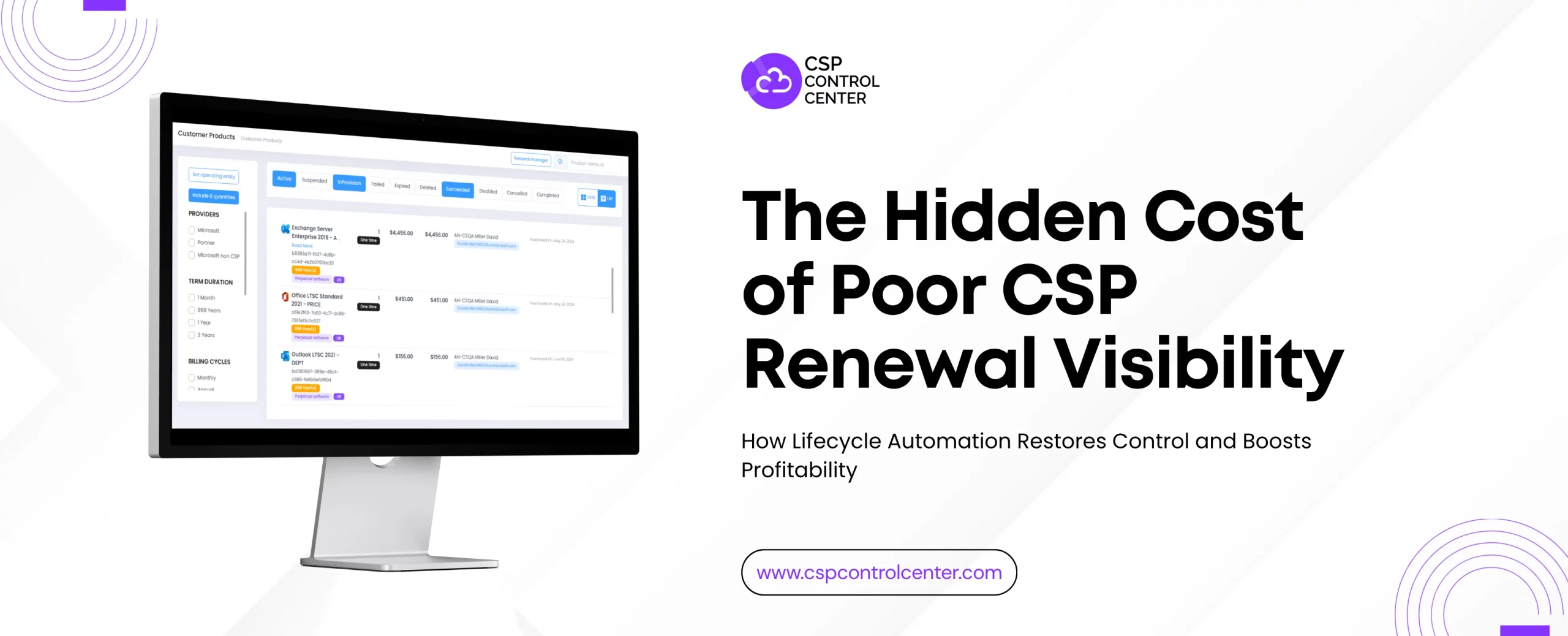

Strengthen Your CSP Operations Before FY26 with C3

If you want to meet the new revenue minimums, maintain compliance, and grow sustainably, you need systems that are reliable, automated, and built for scale. CSP Control Center or C3 provides the unified platform you need to navigate these changes. From automated billing and usage reconciliation to subscription management, customer self-service, and real-time revenue insights, C3 gives you the structure and visibility needed to run efficient operations.

Whether you are a direct-bill partner racing to reach the $1 million threshold, an indirect reseller managing multiple customer tenants against the new minimums, C3 gives you the automation and insights to stay ahead. It helps you eliminate manual errors, track TTM performance with accuracy, and maintain clean, audit-ready records that align with Microsoft’s expectations. The more predictable and transparent your operations become, the easier it is to meet eligibility requirements and focus your resources on growth.

Book a Demo to see how C3 can help you meet Microsoft’s FY26 CSP requirements, strengthen compliance, and scale profitably.

CSP Control Center

CSP Control Center

CloudEvents

CloudEvents